Philips M1006B Press Module - doc-market - m1006b

The fast-food giant is claiming that meat packers have colluded to artificially raise the price of beef. But the US is actually dealing with a cattle shortage.

Persistent drought, high interest, and an aging farmer population are among the reasons it’s become harder for farmers to grow their herds. Cattle inventories are down to a fraction of what they were a generation ago, according to the Department of Agriculture.

That’s what the fast-food giant is alleging in a lawsuit filed Friday, accusing nine major American meat-packers – among them Tyson, JBS, and Cargill – of artificially inflating the price of beef.

“In a competitive environment, absent a conspiracy, [the meat-packers] would compete to secure as much cattle as possible to expand profitable production,” McDonald’s alleged in its lawsuit. “Instead, [the meat-packers] continued to collude to limit slaughter volumes despite market conditions that encouraged market participants to increase, not decrease, slaughter volumes.”

McDonald’s said the companies started their scheme in 2015 when their profit margins on beef began to shrink. They all agreed to reduce their slaughter volumes and reduce the supply of beef, which would push up prices and improve margins, even amid high demand, McDonald’s alleges.

McDonald’s didn’t want to raise the price of a Big Mac beyond recognition and turn their back on their value-focused consumer base. It was the meat-packing companies that made them do it!

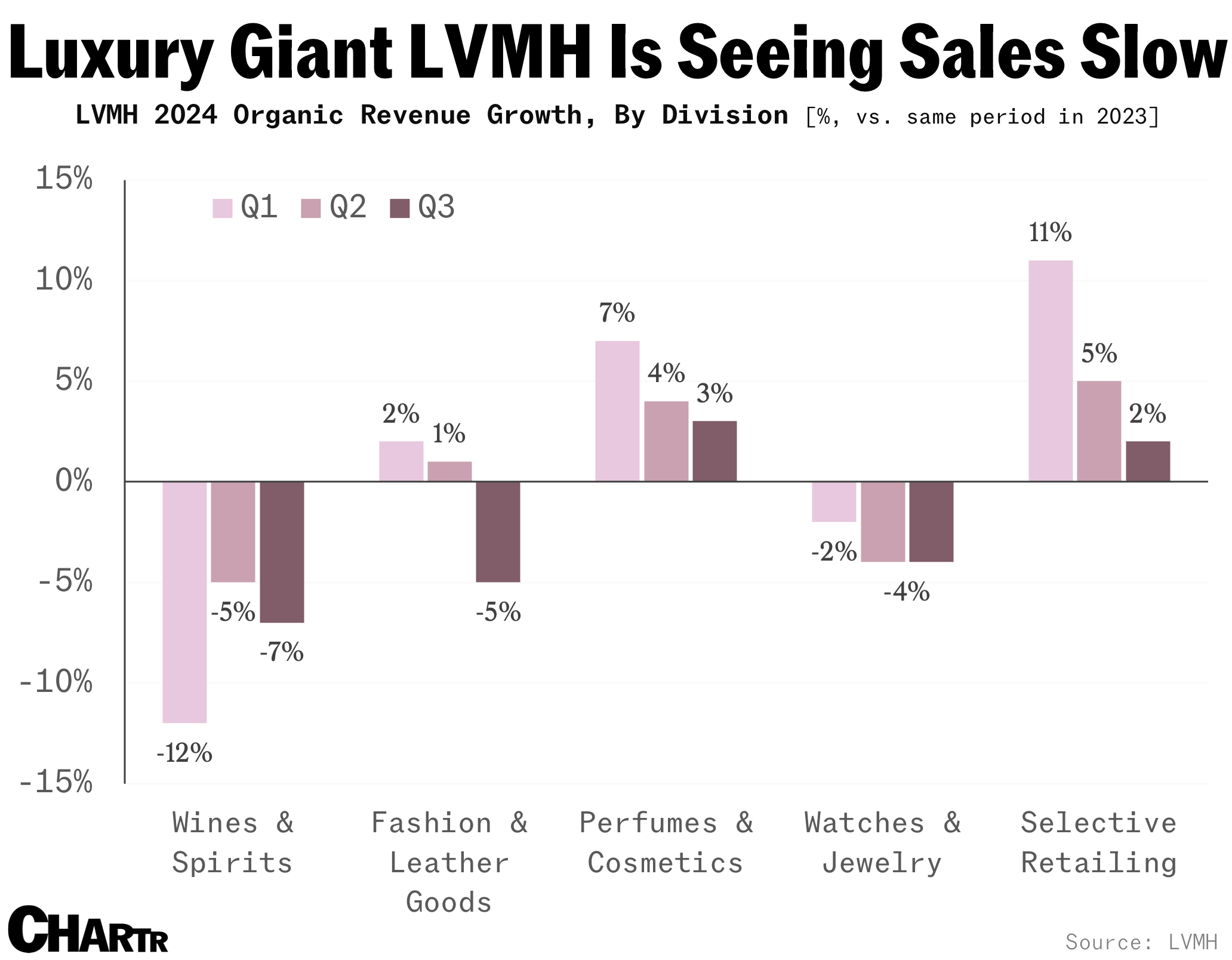

The company’s crucial Fashion & Leather Goods brands weren’t looking much sharper — organic sales (which strips out currency impacts) fell 5%, a significant drag on the company’s bottom line considering that the division accounted for 49% of LVMH’s revenue.

The market seems to have gotten over Tuesday’s news of a sharp slowdown in orders for the most sophisticated chipmaking machines on earth.

In 2022, JBS agreed to a $52.5 million settlement in one claim from direct purchasers accusing it of price-fixing. Ranchers also unsuccessfully sued meatpackers, who they claimed artificially depressed the price they are paid for their cattle.

The average price of a McDonald's menu item is up 40% since 2019. That has caused its customer base, which has come to rely on it for a cheap meal, to pull back. The Golden Arches have tried to lure them back through value meals.

The biggest decline came in the company’s Wines & Spirits division. Despite housing iconic Champagne labels like Moët & Chandon, Veuve Clicquot, and Dom Pérignon, sales fell 7%, compounding a miserable year for the division, where revenue has dropped every quarter.

But actually, there is less cattle supply than there used to be, which economists generally attribute as the reason beef prices have soared.

Meat-packers like Tyson and JBS buy cattle from farmers then process it to products sold in supermarkets or to restaurants like McDonald’s. Tyson and JBS (the only two public companies listed in the complaint) have consistently cited a shortage in the supply of cattle for their higher beef prices.

The handful of meat-packing companies listed in the lawsuit control the vast majority of the meat market in the US, and they have been accused of anticompetitive practices in the past.

Shares in the world’s largest luxury-goods company slipped more than 7% in early trading this morning, after LVMH reported lackluster sales growth yesterday. Bernard Arnault’s Paris-listed company, which owns Louis Vuitton, Dior, Givenchy, and 70+ other luxury brands, was hit particularly hard by weaker demand in China.

That’s in line with the American Farm Bureau Federation’s explanation, which is that beef prices have gone sky-high because cattle inventory has gone down and the market isn’t giving farmers incentives to grow their herds.

Neil

Neil

Neil

Neil