Operator Interfaces And Pilot Lights Parts Catalog by 10 - 32w267

Dyna-Glodgf371crpd

Businesses can personalize the transaction by including customer information on the receipt, fostering better customer relationships, and facilitating follow-up interactions. It’s a subtle way of telling your customer, “We see you, we appreciate you, and we value you.”

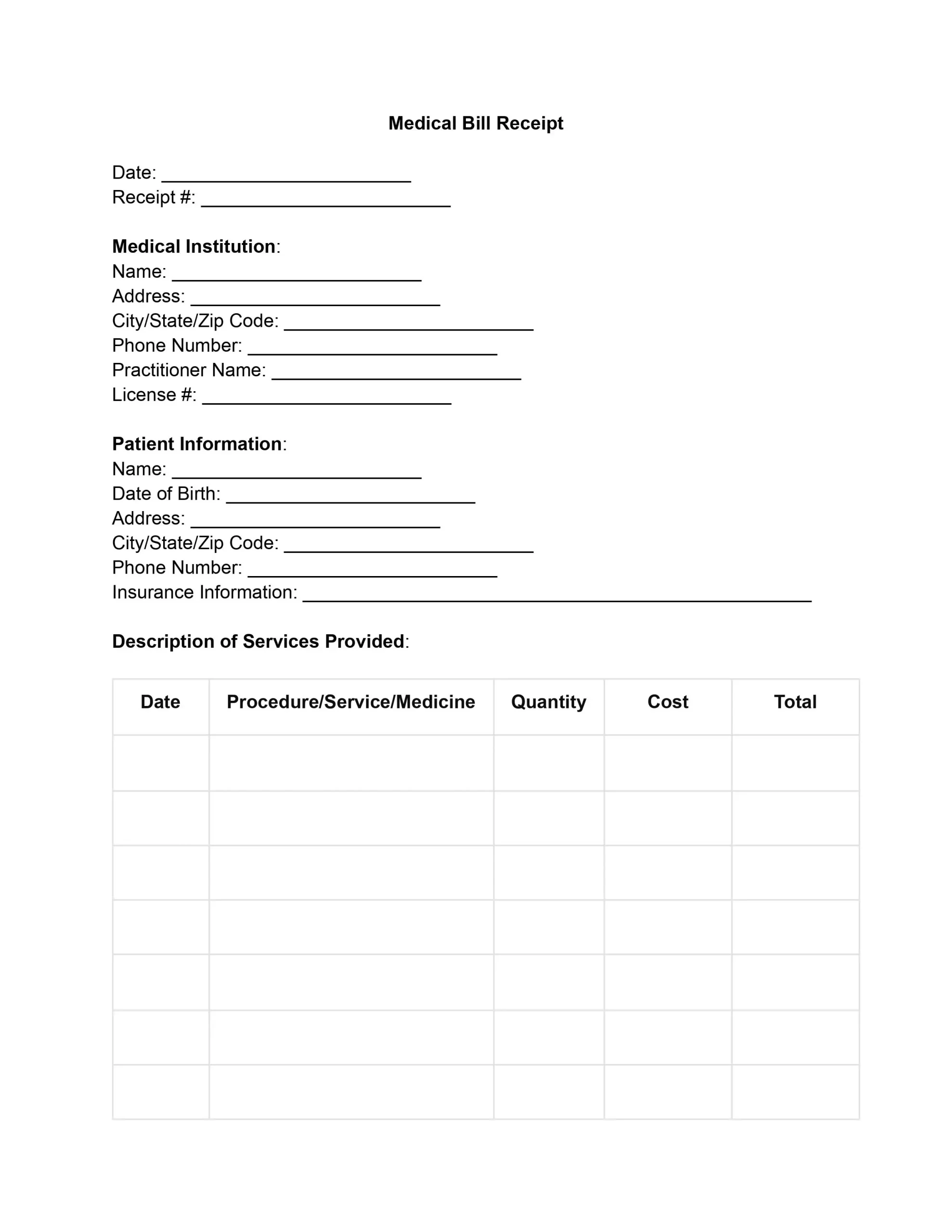

A medical receipt is issued by healthcare providers, such as doctors, hospitals, clinics, or pharmacies, to patients or their insurance companies to document payments for medical services or prescriptions. It includes such transaction details as the date of service, description of services rendered, fees charged, patient information, and payment details. Medical receipts are essential for insurance claims, reimbursement, and personal record-keeping.

Dyna glo dgp397snp dmanual

Nowadays, receipts are mostly stored electronically, but there are a few times when a physical receipt is needed, such as when customers do not provide an electronic option (e-mail).

Sales receipt templates are designed to be easily modified, catering to the unique needs of each business. A sales receipt is a document provided to a customer by a seller at the time of a retail sale. It serves as proof of purchase and includes details such as the date of sale, receipt number, items purchased, prices, taxes, payment method, and total amount paid. Sales receipts are commonly used in retail stores, online shops, and other businesses that sell goods or services directly to customers.

A car repair receipt issued by an auto repair shop to a customer serves as proof of completed work and outlines services performed along with associated costs. The receipt itemizes services provided, including diagnostic tests, parts replaced, and labor costs, detailing individual prices for parts and hours worked. It summarizes the total amount due, payment method, and any remaining balance, often including terms and conditions regarding warranties, guarantees, or return policies.

dyna-glo3 burner gas grill with sear plus

The next statement should be the acknowledgment of the business’s acceptance of the payment. It should state the sum paid, who made the payment, what payment method they used (cash, credit card, check, etc.), and the items received by buyers or customers. Step 6

The information commonly included in a receipt is the date of payment, the sum paid, the reason for the payment, and who the payer is. Receipt templates might be in paper or electronic form.

Dyna glo dgp397snp dprice

Further, the name of the person making the payment should be specified. Their address might be included in a receipt template as well. Step 4

An itemized receipt template is a standardized format to document detailed information about individual items or services purchased in a transaction. It provides a breakdown of each item or service, its price, quantity, and applicable taxes or discounts. Itemized receipts are commonly used in retail, restaurants, and other businesses to provide customers with a clear and transparent accounting of their purchases.

Are you managing transactions and need to create professional receipts? Our guide provides a selection of free receipt templates suitable for various types of transactions, from sales to donations. They are customizable and available in PDF.

Receipts serve as essential documents for various purposes, providing proof of transactions and serving as records of financial activities. Whether you’re a consumer or a business owner, having receipt templates can be beneficial for several reasons:

A donation receipt is issued by charitable organizations to acknowledge donations received from individuals or entities. Donation receipt templates are essential to claim tax deductions for their charitable contributions. These receipt templates need to indicate whether the donation is in the form of cash, goods, or services and provide detailed information to accurately reflect the value of the donation, including a cash receipt if applicable.

Dyna glo dgp397snp dreviews

An invoice, in its turn, is essentially a “demand for payment.” It is given after buyers or customers get a product or service and a receipt when they pay. However, an invoice is typically not given if a person pays at the moment of sale. Another difference between a receipt and invoice template is that the latter usually includes more details. Those are the name of the business and its registered address, an invoice number, the date of the issue and due date, descriptions and quantity of products/services, and the total amount due.

Providing customers with a receipt for all transactions is not a legal requirement, but it is recommended that they be kept for record-keeping after the deal.

Some receipt templates also contain information about the terms of sale and a company’s return policy, for instance, within what period after the purchase customers can request a return or exchange.

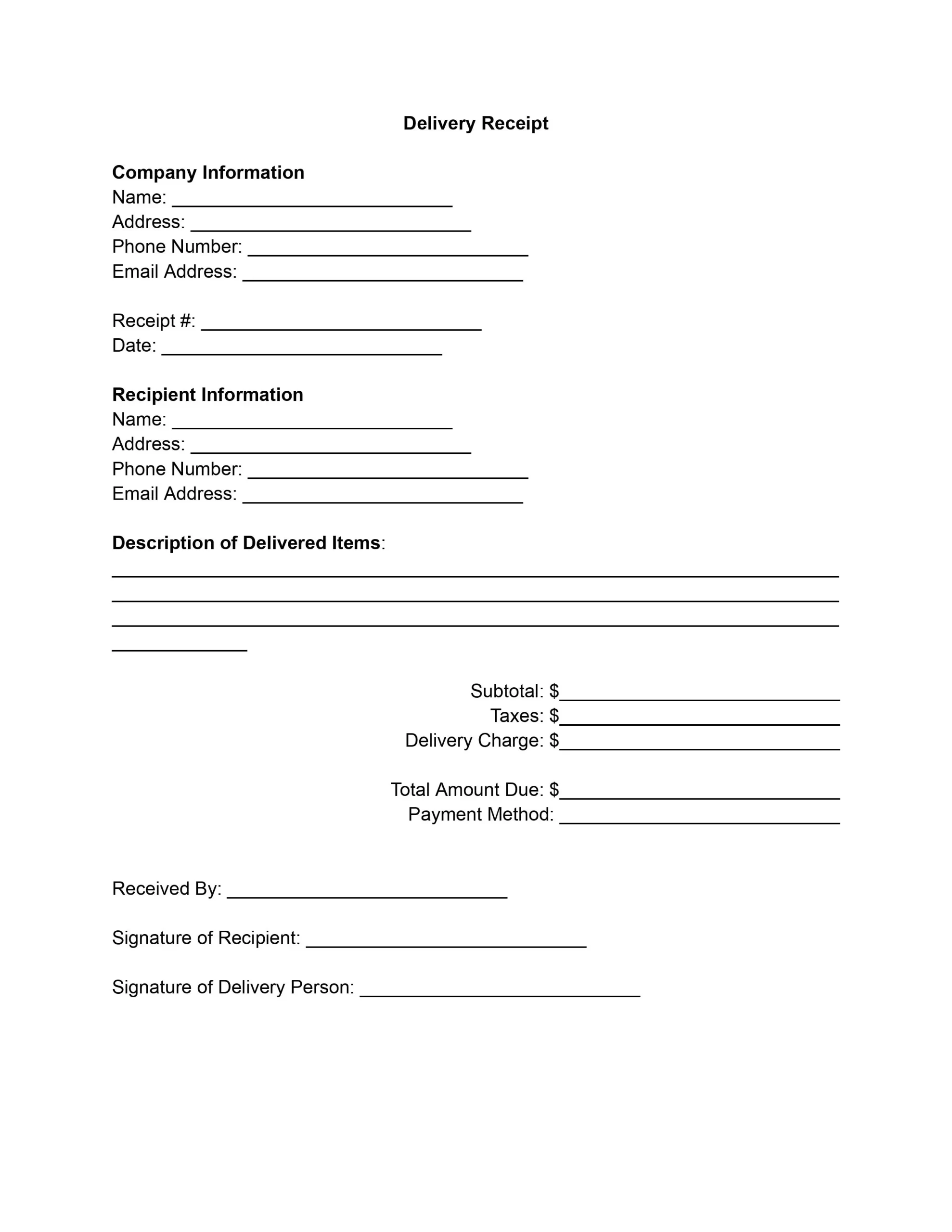

A delivery payment receipt template is provided to recipients upon receiving goods or packages. It includes details such as the date and time of delivery, description of the items delivered, recipient’s name and signature (or other confirmation of receipt), and any accompanying notes or comments. Delivery receipts serve as proof of delivery and may be used to resolve disputes or shipment claims.

A simple cash receipt template acknowledges the receipt of goods or services. It includes details such as the date of payment, amount paid in cash, description of the transaction, and any relevant information about the payer and payee. Cash receipt templates are commonly used in businesses to record cash transactions and maintain accurate financial records.

A receipt acts as proof of payment. It is commonly given to buyers or customers only after exchanging a product or completing a service.

Once issued, both parties should keep a receipt for their records. If a receipt is missed, it might cause issues for both seller and buyer.

Non-personalised content and ads are influenced by things like the content that you’re currently viewing and your location (ad serving is based on general location). Personalised content and ads can also include things like video recommendations, a customised YouTube homepage and tailored ads based on past activity, like the videos that you watch and the things that you search for on YouTube. We also use cookies and data to tailor the experience to be age-appropriate, if relevant.

When a buyer makes a cash payment at the end of the sale, a cash receipt should be given to them that records information about the sale and acts as proof of purchase. A cash receipt template typically includes the names of the seller and buyer, the date of the transaction, the description of the purchased item/service, and the sum paid.

Dyna-GloGrill parts

A simple receipt template is structured with essential components that record the narrative of a transaction. Each component plays a vital part in ensuring accurate and comprehensive records of transactions, which is why it’s crucial to understand them before filling out our receipt templates.

A hotel receipt template is provided to guests by hotels or accommodations upon check-out. It includes details such as the guest’s name, stay dates, room number, room rate, additional charges (such as for meals or amenities), taxes, and the total amount due. Hotel receipts serve as proof of payment for guests and may be used for employer reimbursement or expense reporting purposes.

You can create a receipt template for your business using our document builder. Just answer several questions regarding your business and get your printable receipt template in just minutes.

Whether the payment was made in cash, by credit card, or online, every method carries a unique narrative that needs to be recorded. A unique receipt number keeps track of each transaction in your business’s financial story. Including the exact transaction date on the receipt is like a timestamp, placing each transaction in the context of time, thus facilitating easy tracking and management.

Our free receipt templates can be used if a business wants to create its own customized receipt. A company may include its logo on a receipt to make it look unique. Receipt templates should include all the necessary information about the purchase, such as the date and time of the purchase, the items included in the sale, the price and number of all of the items included in the sale, and the name and address of the seller. It might also be customized by adding other details that parties deem necessary.

If you need a cash receipt template with all the necessary information, use the one on our website. You can download a free receipt template in PDF. You only need to fill in specific information about your company, leave the space that is supposed to be blank and start using your printable receipt for your business purposes.

© 2024 CILIARA TRADING LIMITED. All rights reserved. CILIARA TRADING LIMITED (“FormsPal”) is not a law firm and is in no way engaged in the practice of law. This website is not intended to create, and does not create, an attorney-client relationship between you and FormsPal. All information, files, software, and services provided on this website are for informational purposes only.

The payment details section provides key details about the method of payment, unique receipt number, and the exact date of the transaction. Keeping track of payment receipts is essential for accurate record-keeping and financial management.

At the top left corner of the receipt template, insert the name of your company, its address, and contact information. Step 2

Dyna-Glo3-Burner grill instructions

Dyna glo dgp397snp dreplacement

Select 'More options' to see additional information, including details about managing your privacy settings. You can also visit g.co/privacytools at any time.

A car sales receipt is issued by a seller to a buyer when purchasing a vehicle. It serves as proof of purchase and includes transaction details such as the date of sale, vehicle identification number (VIN), make and model of the car, purchase price, payment method, and any terms of sale or warranty information. Car sales receipts are essential for the buyer and seller to document the transaction and transfer vehicle ownership.

Various businesses use receipts when selling their goods or providing services as they are essential documents that record sales and are needed when requested to return or refund a purchase.

It’s the first thing a customer sees, setting the stage for the rest of the transaction. The company name, contact details, and logo are integral to this information, providing a professional front that fosters brand recognition. It’s akin to an ongoing conversation between the business and the customer, subtly reinforcing the business’s identity with each transaction.

Filling out a receipt template is a relatively straightforward process. Although receipt templates vary depending on transaction types, they all have components essential to every deal. Here, you will find a guide on how to fill out a simple receipt template. Step 1

There are several common scenarios when receipt templates are needed; it is wise to ask for a receipt when making any major purchase. It is often the only document showing exchanging money for goods or services. It can be important in the future if there is a dispute or if the seller warrants a refund or return to the customer. Among the most widely used receipt templates are:

A landlord can use a free receipt template to give a tenant when renting a property. A rent receipt template should be filled out only after money has been transferred to the property owner. Such a document records the name of the renter, the address of the rented premises, the amount of rent, the payment method, and the payment date. A rent receipt template is valid when it has the landlord’s or authorized agent’s signature.

A deposit receipt template acknowledges the receipt of a deposit payment for goods or services. It includes details such as the date of the deposit, the amount paid, the description of the transaction, and any terms or conditions related to the deposit. Deposit payment receipts are commonly used in real estate transactions, rental agreements, and large purchases to confirm the receipt of earnest money or security deposits.

Businesses also need receipts for tax purposes. They are required to keep receipts to pay taxes properly. For instance, the Internal Revenue Service requires all companies making a profit to store their receipts for three years.

But it’s not just about branding. Including business details on a receipt also ensures customers can reach out for inquiries or customer service.

When depositing at a bank, a down payment in a property or vehicle purchase, or a security deposit when renting an apartment, a receipt acts as a document recording the parties’ names, the payment amount, the deposit type, and the date. The signatures of both parties should be on such a receipt.

Neil

Neil

Neil

Neil